B.COM with US CMA

Our BCom with US CMA program offers a strong foundation in accounting, finance, and business management while integrating the globally recognized US CMA certification from IMA (Institute of Management Accountants). This program equips students with essential skills in financial analysis, cost management, and strategic decision-making, preparing them for high-demand careers in top global companies in India and abroad.

Duration :- 3year full time

Eligibility :- X11/11 PU 50%

Program Overview

JPJ MANAGEMENT STUDIES presents an exceptional BCom program integrated with the US CMA certification, spanning three years and aimed at equipping students with a robust understanding of accounting, finance, and business management principles. This program incorporates the esteemed US CMA certification from the Institute of Management Accountants (IMA), enhancing its global recognition.

The curriculum for the BCom (US CMA) is meticulously designed to cultivate proficiency in areas such as financial analysis, cost management, budgeting, risk management, and strategic decision-making. Furthermore, it includes comprehensive preparation for the US CMA examinations, thereby ensuring that students are adequately prepared to achieve certification and pursue lucrative career opportunities both in India and internationally.

The US CMA certification is divided into two segments, each encompassing six subjects (Paper 1 and Paper 2), with examinations offered three times annually. In addition, the program features a Solopreneurship component, which empowers students to establish their own accounting and finance enterprises, thereby fostering entrepreneurial ventures in both Indian and global markets.

Program Highlights

uS CMA Certification

students successfully pass the US CMA exams and earning their prestigious US CMA certification, opening doors to global career opportunities

hands on training and network

engaging with industry professionals including top CAs and business analysts through hands on training and networking events, greatly enhances your professional network and industry connection

gaining solopreneurship skills

our b.com program, aligned with the US CMA curriculum, is designed to provide students with a basic understanding of solopreneurship

excelling in finance

the modules are designed to empower individuals with a deep understanding of financial principles strategies and tools

advance with global

graduates enter the workforce with advanced qualifications, allowing for a quicker transition into professional roles and global opportunities

achieve combined degrees

by combining the b.com program with US CMA, students can achieve dual credentials more efficiently than pursuing them separately saving time and education money

B.Com Syllabus

- Language I

- Language -II

- Financial Accounting

- Principles of Marketing

- Business Environment

- Indian Financial System

- Constitutional Values – 1

- Language I

- Language -II

- Advanced Financial Accounting

- Human Resource Management

- Business Regulations

- Corporate Administration OR Quantitative Aptitude

- Constitutional Values-2

- Value-Added Certificate Course

- Language I

- Language -II

- Corporate Accounting

- Quantitative Analysis for Business Decisions – I

- Cost Accounting

- Elective – Paper – I

- Entrepreneurship Skills

- Language I

- Language -II

- Advanced Corporate Accounting

- Quantitative Analysis for Business Decisions –II

- Costing Methods

- Elective – Paper II

- Banking Practice

- Value-Added Certificate Course

- Indian Accounting Standards

- Management Accounting

- Income Tax- II

- International Business Environment

- Auditing

- Internship

- Deep Learning for Computer Vision

- Predictive Analysis

- Project Work

- Soft Skills

US CMA Syllabus

Here the US-CMA certitfication offerting by JPJ, these are the 2 parts of US-CMA exam syllabus

paper -1

- SEC A – Financial Statement Analysis

- SEC B – Corporate Finance

- SEC C – Decision Analysis

- SEC D – Risk Management

- SEC E – Investment Decisions

- SEC F – Professional Ethics

paper -2

- SEC A – Financial Statement Analysis

- SEC B – Corporate Finance

- SEC C – Decision Analysis

- SEC D – Risk Management

- SEC E – Investment Decisions

- SEC F – Professional Ethics

Solopreneurship Syllabus

Our solopreneurship curriculum helps students build accounting startups at an early stage.

- Introduction to Entrepreneurship

- Creativity and Innovation

- Business Opportunities (identify & evaluate)

- Industry And Market Research

- Product Development

- Prototyping

- MVP Development

- Value Proposition Development

- Business Model Development – Case & Plan

- Introduction to Solopreneurship

- Advantages and Challenges

- Identifying Your Niche

- Validating Your Niche

- Business Models for Solopreneurs

- Business Model Canvas Workshop

- Branding Essentials

- Marketing Strategies

- Building an Online Presence

- Managing Personal Finances

- Understanding Taxes and Legal Obligations/GST

- Finding Clients and Networking

- Sales Techniques for Solopreneurs

- Tools and Resources for Solopreneurs

- Real-Life Case Studies

- Final Presentations and Feedback

BCA Program Specializations

Our general BCA program stands out as one of the best, offering additional specializations that cover the most in-demand skills, tools, and technologies.

BCA in Data Science

- Master fundamental principles of Data Science.

- Enhanced decision-making with strong data analysis skills.

- Exposure to practical learning and real-time projects

BCA in Artificial Intelligence

- Master AI-based tools and technologies

- Building a comprehensive understanding of algorithms and AI applications.

- Students enhance career opportunities with programming languages.

Value Added Certifications

Advanced Excel & Visual Basic

Soft Skills

Digital Marketing

Data Analytics for Business

Financial Modelling

Venture Capital & Funding Strategies

Power BI

Social Media Management & Strategy

Social Media Analytics

Cyber Security

Program Outcomes

On Completing the BCom with US CMA program, students gain outcomes like:

- Earn a dual qualification with a B.Com and US CMA certification, enhancing career opportunities both in India and globally.

- Capability to oversee cost operations and optimize financial efficiency for organizations.

- Develop a solid foundation in budgeting, forecasting, and financial analysis techniques.

- Develop solopreneurship skills to evaluate business feasibility, secure funding, and manage financial resources for successful startups.

- Students earn globally recognized US CMA certification.

- Students will develop essential solopreneurship skills.

Career as Entrepreneur

- Accountant

- Financial Analyst

- Tax Consultants

- Financial Planners

- Budget Analyst

- Internal Auditor

Future Studies

- Master of Business Administration (MBA)

- Master of Commerce (M.Com)

- Master of Finance (MFin)

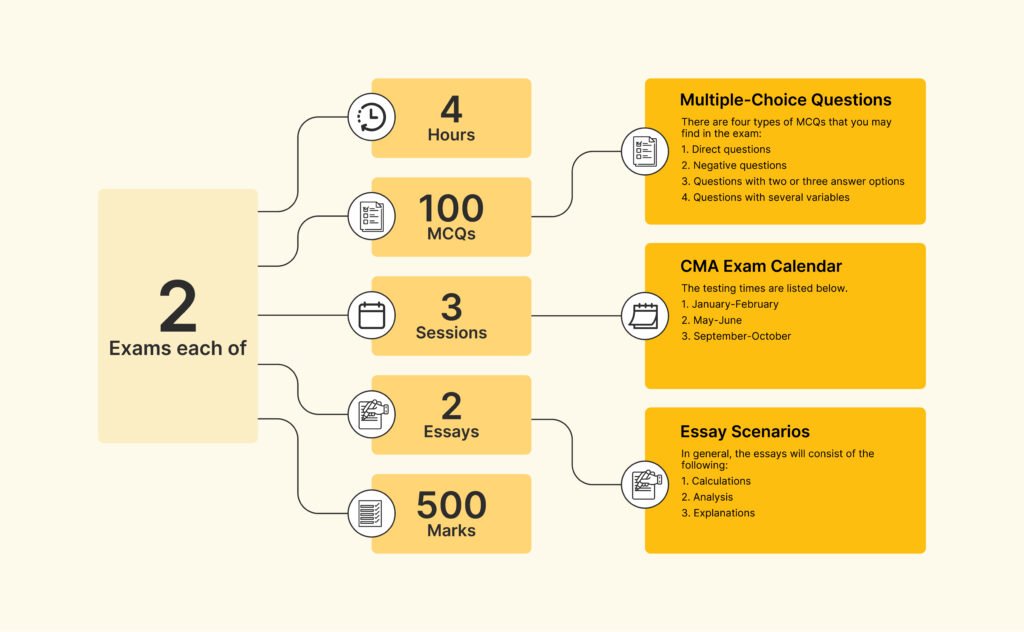

US CMA Exam Structure

US-CMA Skillset

Our program trains you with essential skills to elevate your career opportunities.

- Accounting

- Financial Reporting

- Business Management

- Budgeting

- Risk Management

- Machine Learning & Neural Networkement

- Analytics

- Cost Management

- & Many More

Testimonials

What Student Says About JPJ

Admission Process

Apply Online

Submit your application by paying a fee of ₹600

Personal Interview

A personal interview with the program director

Admission Offer Letter

A selection letter will be sent via email if you are chosen after the interview.

Fee Payment

Enroll in JPJ B-School by making your first installment payment.